LEADING THE ENERGY TRANSITION

At Middle River Power, we do more than just keep the lights on. We are growth-oriented with a strategic focus on finding creative solutions that accelerate the transition and meet the needs of our customers and communities. Our team is comprised of seasoned industry experts that specialize in identifying, optimizing, and developing assets critical for the energy transition. With a specialty in repositioning existing, safe, critical resources with co-located and hybrid renewable development projects, we deliver clean, reliable energy solutions to the customers and communities we serve.

OUR COMPETITIVE ADVANTAGE

Our achievements are a result of experienced leadership, capable young talent, and strong partnerships, which together have worked to deliver outsized, innovative solutions to our customers and sponsors. Founded in 2016 with just 4 employees, we have grown to over 50 professionals in just 8 years, with headquarters in Chicago, IL and regional offices in San Diego, CA and Spokane, WA. Our highly analytical approach encourages creative problem solving and calculated risk taking. We are a team-based organization that fosters a fast-paced, collaborative decision making. Our culture thrives on accomplishment and innovation. We get things done while others look for excuses.

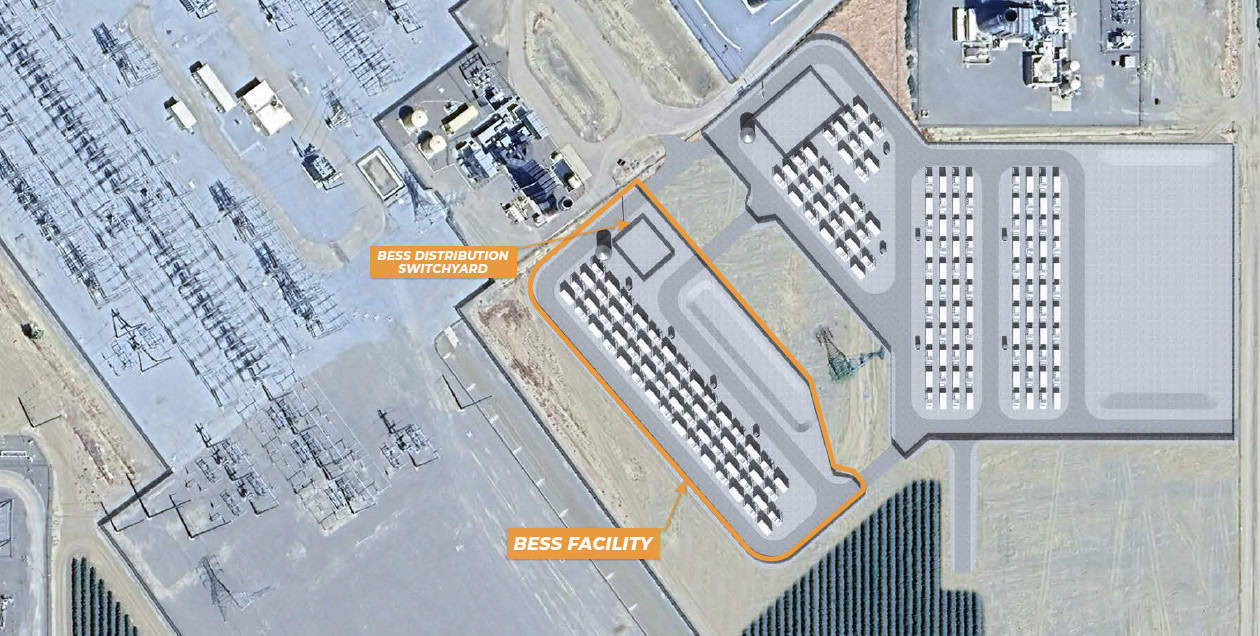

CO-LOCATED RENEWABLE DEVELOPMENT

At Middle River Power, we enable the transition to renewable power at existing generation facilities while maintaining the flexible, reliable characteristics of legacy assets that remain necessary for the US power grid. Our strategy combines new resources with under-utilized legacy generation assets, delivering cleaner, more reliable, and cost-efficient resources, faster than any standalone development. We’ve successfully deployed Battery Energy Storage System (BESS) projects at our existing natural gas peaking fleet throughout California, creating renewable- thermal hybrid energy centers that help achieve the state’s ambitious clean energy goals. This configuration allows us to take advantage of the existing interconnection, which goes unused for 95% of the hours of the year. We bring renewable resources online quickly and more cost effectively by utilizing existing siting, permitting and interconnection infrastructure. The result is immediate greenhouse gas reduction from the existing fleet and delivering a clean, reliable solution to our customers.

OPERATIONAL EXPERTISE

We take pride in our operations-focused Management Team, which adopts a hands-on approach. Our Management Team has decades of experience in developing and managing power generation facilities worldwide. We work closely with plant personnel and maintain strong relationships with experienced industry contractors and consultants to guarantee safe, reliable, and efficient operations. We assess regulatory changes, local generation congestion, utility resource plans, fuel fundamentals, and transmission constraints to identify and optimize ideal resources for investment and transition.

PARNTERSHIP DELIVERS RESULTS

We have established strong partnerships with industry contractors and consultants, across operations, suppliers, large load serving entities, commodity hedging counterparties, and leading financial institutions that we rely on to deliver value for our assets. Collaborating with industry leading partnersis critical to finding innovative solutions and delivering results for our customers We will continue investing in these partnerships and build on our mutual success.

MRP CURRENTLY MANAGES APPROXIMATELY

8,000 MW OF POWER GENERATION ASSETS IN OPERATION OR DEVELOPMENT.

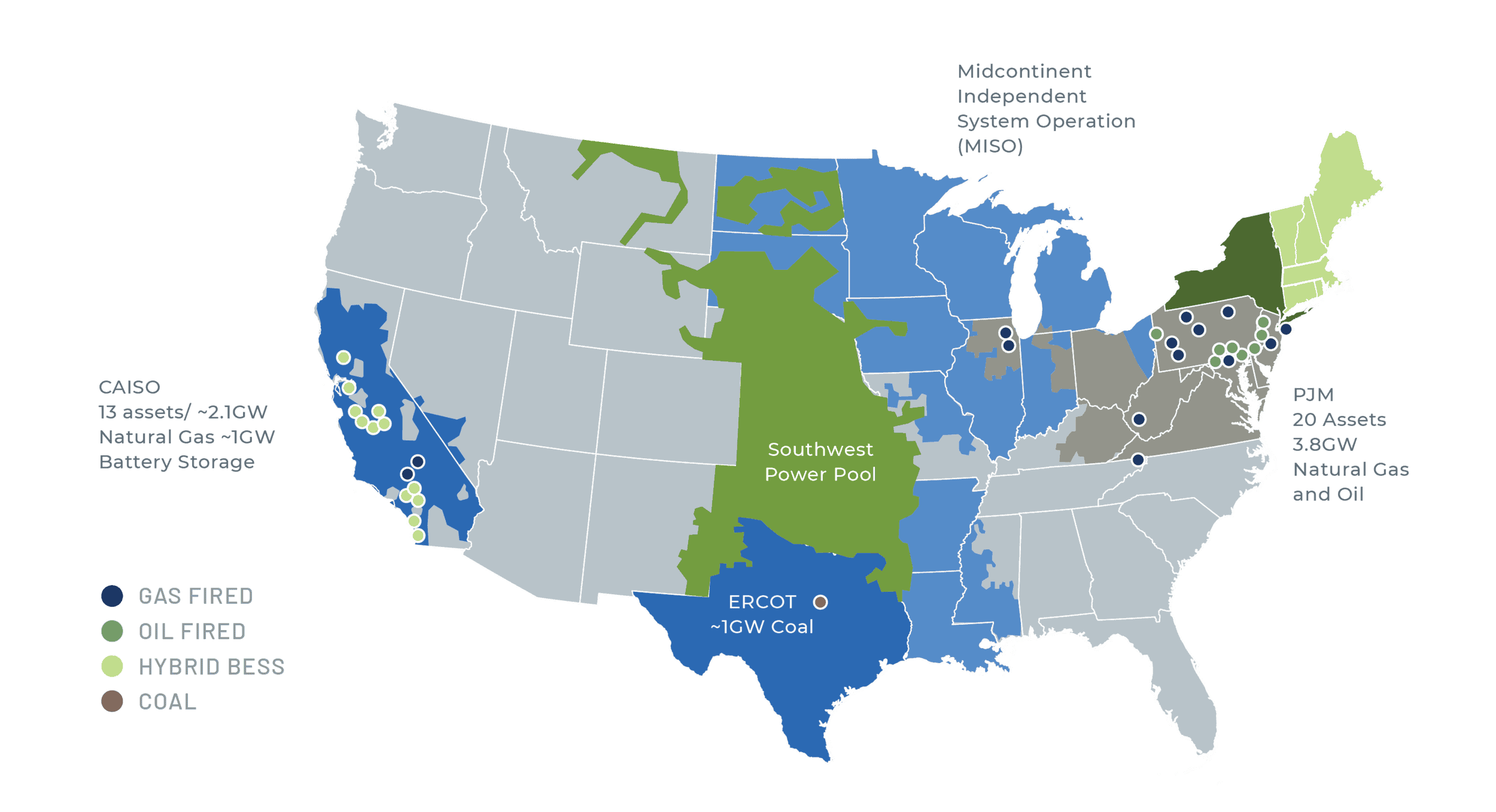

ASSETS UNDER MANAGEMENT OR IN DEVELOPMENT

Includes over 8GW of natural gas, coal, battery storage and solar power generation facilities across PJM, ERCOT and CAISO

Selected Assets in Operation

100% GROWTH SINCE 2020: GROWN FROM 4 EMPLOYEES IN 8 YEARS

-

2016

JANUARY 2016

Acquired High Desert, Big Sandy & Wolf Hills projects

OCTOBER 2016

Raised $270mm term loan B related to acquisition of High Desert, Wolf Hills, and Big Sandy

-

2017

Q1 / 2017

Began Development on High Desert Solar and BESS project

-

2018

September 2018

Acquired Tracy, Hanford & Henrietta

december 2018

Acquired Midway, Malaga Border, Enterprise, Panoche and Vaca Dixon

november 2018

Raised $246mm in credit facilities for Tracy, Hanford and Henrietta, including $187.5mm term facility, $39mm revolver, and $20mm project LOC facility

High Desert performance upgrade, resulting in 36 MW uprate

-

2019

november 2019

Refinancing of High Desert into stand alone financing, Big Sandy & Wolf Hills into separate facility

Q2 / 2019

Long term gas supply agreement for High Desert with Morgan Stanley

-

2020

august 2020

Sold High Desert Solar and Storage Project to MN8 Energy

january 2020

Sierra financing, $224mm senior secured note facility related to Midway, Henrietta, Tracy, Vaca Dixon, Enterprise, Border, Panoche, Hanford, and Malaga

may 2020

Developed Developed Coso BESS Stand alone storage project using excess interconnection at Coso Geothermal facility.

Signed RA offtake with PG&E for Coso BESS // signed offtake with Clean Power Alliance for High Desert Solar and Storage -

2021

may 2021

Took over asset management of Sandy Creek facility in ERCOT

august 2021

Sold Coso BESS to Capital Dynamics

september 2021

Renegotiated offtake with PG&E due to expire in 2022, extending terms for Tracy Hanford, Malaga and Panoch extending terms through 2026

-

2022

april 2022

Closed $750M financing facility on California portfolio

august, november 2021

Renegotiated offtake with PG&E for Midway

november 2022

Negotiated 12-year hybrid offtake with City of San Jose for Henrietta

-

2023

august 2023

Asset managmenet engagement with Heritage Power (former GenOn) portfolio in Pennsylvania, Ohio and New Jersey

august 2023

Acquired Elgin & Rocky Road in Illinios

november 2023

Pacifica financing of $250M in construction and tax equity bridge loan for hybrid storage projects. Morgan Stanley provided first of its kind tax equity financing commitment.

november 2023

High Desert entered with High Desert FX upgrade, resulting in 75MW uprate and decreased heat rate

june 2023

Negotiated 15-year hybrid offtake with Silicon Valley Clean Energy Authority for Hanford

july 2023

Negotiated 15-year hybrid offtake with East Bay Community Energy Authority for Malaga

-

2024

February 2024

Negotiated 15-year hybrid offtake with Central Coast Community Energy for Panoche and Midway

May 2024

Negotiated 15-year hybrid offtake with San Diego Community Power for Border and Enterprise

October 2024

Malaga BESS COD

-

2025

January 2025

Henrietta BESS COD

Hanford BESS CODJuly 2025

Border BESS COD

-

2026

January 2026

Midway and Panoche

BESS CODJuly 2026

Enterprise BESS COD

-

2027

January 2027

Tracy and Vaca Dixon

BESS COD

WE BELIEVE IN COLLABORATION AND HARD WORK.

We believe that with experienced leadership, capable young talent, and strong partnerships we can collaborate to deliver outsized, innovative solutions. Founded with 4 employees, a couple of laptops, and a lot of enthusiasm, we have grown to 60+ professionals headquartered in Chicago, IL with regional offices in San Diego, CA and Spokane, WA. Our highly analytical approach encourages creative problem solving and calculated risk taking. We are a flat, team-based organization. We enjoy what we do, how we do it, and who we do it with. We have each other’s back.

To learn more about the team, click here.

Mark Kubow

James Suehr

Graham Baldwin

Jeremy Meattey

Brant Yung

Joe Dubinski

Ed Karas

Dan Harmon